Ultratech (UTCEM) reported quarter 3FY18 earnings below our expectation due to lower than expected realizations. Though it missed our realizations estimates, a big positive surprise on volume growth compensated to a significant extent. We believe that current quarter doesn’t reflect the steady run-rate of realizations and hence, we keep our earnings estimates unchanged for FY18E/FY19E. Given the strong pipeline of capacity addition (11mn tonnes (t) in next two years), the smooth merger of JPA plants and quality operations, UTCEM is best placed to exploit the recovery in demand. We maintain Accumulate with TP of Rs4,900, EV/EBITDA of 16x FY20E.

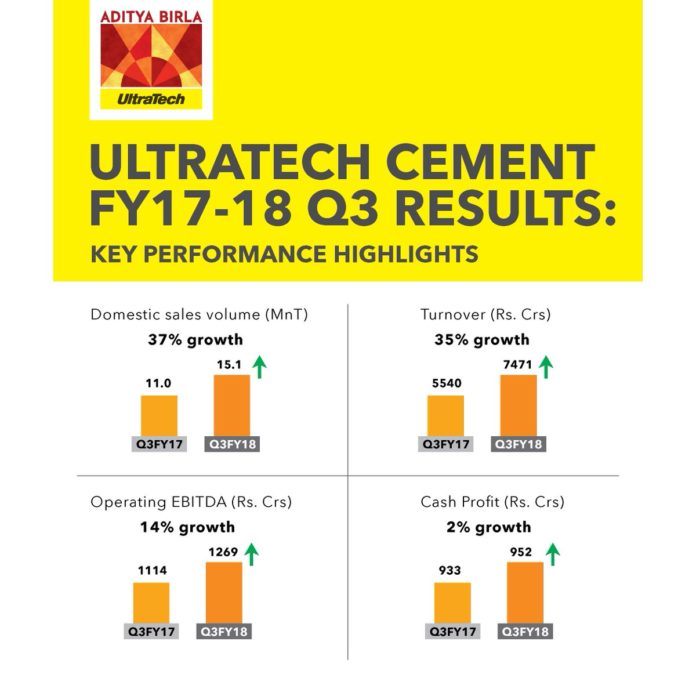

Lower realizations drove the miss: Led by earlier than expected ramp-up of acquired JPA plants and strong organic growth, domestic grey cement volumes rose 37per cent Year on year at 15.1mn t, above our estimate of 13.2mn t. Total volumes (including exports and white cement) rose 35per cent Year on year at 15.9m (PLe:13.9m) t. Blended realisations fell 0.2per cent Year on year/Rs10 (down4.4 percent QoQ/Rs216) at Rs4,714/t, below our estimate of Rs4,870. Cost/t rose 4 percent Year on year/Rs155 to Rs3,988 (PLe:Rs3,961) due to 21 per cent/6 per cent increase in energy/freight cost. Marred by higher costs, EBITDA/t fell 18.5 percent/Rs165 to Rs726 (PLe:Rs909). Offset by higher volumes, EBITDA rose by 10 percent Year on year to 11.5bn (PLe:12.6bn). Impacted by an increase in depreciation/interest cost, PAT fell by 38 percent Year on year at Rs3.5bn (PLe: Rs4.0bn).

Key highlights of con-call: 1) Acquired plants operated at 51 percent utilization 2) Exited with 60 percent mark in December and expects to operate at higher levels on January 3) Cost of production of acquired plants higher by Rs100/t v/s own plants. The differential would diminish in next couple of quarters with the change in fuel mix and higher efficiencies 4) All-India demand grew by 4-5 per cent/10 per cent/10 per cent+ Year on year in Q1/Q2/Q3 3FY18 5) 30-35mt capacity addition in India by FY19 including 11mt by UTCEM 6) Its North/Central/East/South/West based plants operated at 80 per cent/60 per cent/80 per cent/70 per cent/53 per cent in QUARTER 3.

About Ultratech:

UltraTech Cement Ltd. is the largest manufacturer of grey cement, Ready Mix Concrete (RMC) and white cement in India. It is also one of the leading cement producers globally. UltraTech as a brand embodies ‘strength’, ‘reliability’ and ‘innovation’. Together, these attributes inspire engineers to stretch the limits of their imagination to create homes, buildings, and structures that define the new India.

The company has an installed capacity of 93 Million Tonnes Per Annum (MTPA) of grey cement. UltraTech Cement has 18 integrated plants, 1 clinkerisation plant, 25 grinding units and 7 bulk terminals. Its operations span across India, UAE, Bahrain, Bangladesh and Sri Lanka. UltraTech Cement is also India’s largest exporter of cement reaching out to meet the demand in countries around the Indian Ocean and the Middle East.