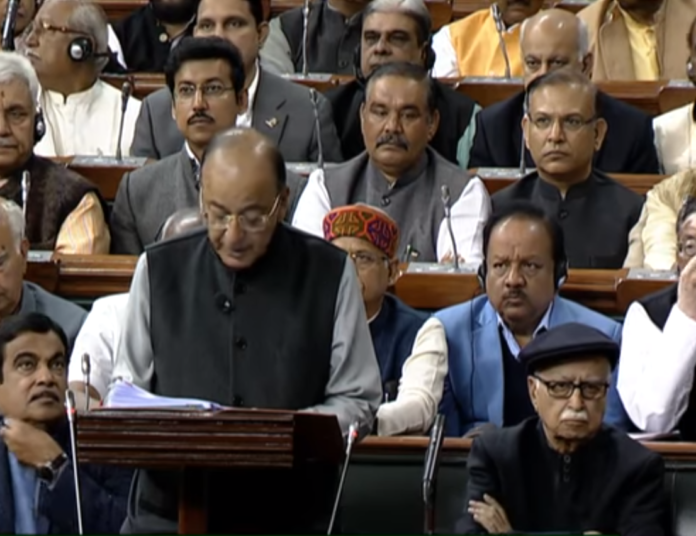

Rakesh Tarway – Head Research, Reliance Securities jots down the sectors and stocks that will be benefitted or hit from the announcements made by the Finance Minister in the Budget today.

There are all efforts in Union Budget 2018 to appease rural and EWS population but at the same time Government tried to maintain the fiscal discipline by keeping fiscal deficit target at 3.5% and 3.2% for FY18E and FY19E, respectively. Although deficit targets are higher as compared to previous estimates but considering surge in prices of crude oil these are respectable numbers. Higher than estimated expenses and lower than expected revenue on account of lower GST collection and no spectrum auctions lead to miss on fiscal deficit targets. Budget speech has talked about total expenses from all agencies at Rs 14lac crore towards aiding rural economy/farmers’ income. This will have a far-reaching impact on growth rates of country and reduction of income gaps in society. Companies and sectors deriving the majority of revenues from the rural economy like 2 wheelers, FMCG Companies, fertilizer companies will benefit from the push to rural spending. We like HUL, Hero Motocorp, ITC, Godrej Agrovet to benefit from the move.

Budget 2018 continued to put a strong focus on infrastructure development, which is in line with the expectations. FM has allocated an extra-budgetary support of Rs5.97 lakh crore v/s Rs3.96 lakh crore in the last budget for the infrastructure sector, which is encouraging as India needs a large amount of investment in infrastructure due to growing needs. We understand higher allocation in infrastructure segment will essentially expedite infrastructure development in the country, which in turn will aid many industries i.e. metals, cement, building materials, etc. We like construction companies like KNR Construction, J Kumar, NCC to play infrastructure theme from the budget. We also like cement companies like JK Cement and Sagar Cement to benefit from push to infra.

Union budget has also proposed coverage of Rs 5Lac per household to total 10 Cr households for hospitalization. The move will benefit hospital chains like Apollo Hospitals and Narayana Hrudyalay. It will also have a positive rub-off impact on companies like Thyrocare and Dr. Lal Path Labs. Insurance companies will also benefit because of insurance premium received towards coverage of families.

Among other major initiatives budget has proposed the creation of affordable housing fund under NHB. This will benefit all affordable housing players like Mahindra Lifespace, Ashiana Housing etc. It will also have a positive impact on affordable housing financiers like Gruh Finance, DHFL, and Can Fin Homes.

Within tax proposals, the budget has proposed to increase customs duty on imported Truck and Bus Radials from 10% to 15%, which will benefit companies like Apollo Tyres and JK Tyres who have major exposure towards truck tyres.

Govt has also decided to impose 10% tax on Long-Term Capital Gains (LTCG) for equity and equity-oriented investments for an amount exceeding capital gains of Rs1 lakh. The tax will be applicable based on cost prices prevailing on 31st January 2018, which will prevent any large scale selling in stock markets. While LTCG tax has been imposed, there is no tinkering on Securities Transaction Tax, which makes India as a probably only country in the world to have both taxes at the same time. Grandfathering of cost prices for LTCG will prevent any knee jerk reaction in stock prices but the imposition of the tax is a clear negative for equity markets as far as sentiments are concerned.

To summarise, we believe that amid the challenges from soaring oil prices, dwindling revenue collection led by the transitory impact of GST and lack of private capex, FM has managed to provide a balance of maintaining fiscal prudence and spurring economic growth.