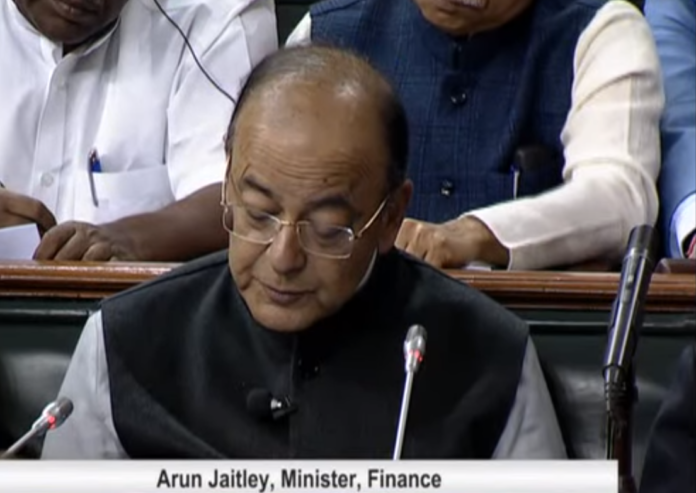

Finance Minister, Arun Jaitley presented the Union Budget 2018-19, today in the parliament. The Budget has a lot of things for the market including extra taxations and tax cuts for corporate. Here is what the market experts had to say about the budget:

Adhil Shetty CEO and Co-founder BankBazaar said:

Views on Insurance

“Rs5Lac is a great mediclaim amount and 50 Cr individuals is a great target. This will create tremendous awareness for medical insurance in the same way as Jan Dhan which ensured every Indian to have a bank account. This will push for every Indian to have medical insurance. On life insurance, the PM Jeevan Jyoti Bima Yogana including Rs 2Lac Life cover is being pushed across a larger base which is a great sign. Rs 2 Lac critical cover is also being extended to a larger base.”

Views on Taxes

“Reduction of corporate income tax for companies with revenue up to INR 250Cr is a big announcement and will benefit more than 99% of the companies in India. The framework is still to be analyzed to qualify the benefits. Another announcement on standard deduction of INR. 40,000 for the salaried class is a great step to simplify the taxation process. Though the effect would not be much as the 40k deduction in lieu of medical and travel allowance effectively only means INR 40k- (15k+9.6k existing ) which is only INR 15.4K extra non-taxable income. At 20% tax slab, it is approximately INR 3080 in hand for a full year. This will further get reduced because of the increase in health and education cess of 1% on tax (existing 3%) which means only approx. INR 2000 in hand per year increase”

Fintech perspective :

“The budget overall is positive. There is visible support for Fintech industry as the FM specifically mentioned that Fintech is playing an important role in countries growth and hence announced setting up a working group for its growth. The biggest announcement was about insurance and Rs5Lac is a great mediclaim amount and 50 Cr individuals is a great target. This will create tremendous awareness for medical insurance. Also, reduced corporate income tax for companies with revenue up to Rs250Cr is a big one. There are a couple of points which will raise questions. The 3.5% fiscal deficit in FY18 and 3.3% fiscal deficit target in FY19 is slightly higher than expected which will impact the borrowing cost for the Private sector. Second, an introduction of a tax on LTCG exceeding Rs. 1Lac after 14 years.”

On Investment:

“The announcement of the LTCG on equity investments and 10% DDT saw the Sensex plunge 1% within minutes. However, the markets seem to have recovered immediately signaling that equity investors — including mutual fund investors — would absorb these blows and keep investing as per their financial objectives. After all, equity remains one of the best-performing asset classes.”

Manav Jeet, MD & CEO, Rubique said:

“Today’s budget announcements are certainly creating a headway for India to become the largest digital economies in the world. Right from plowing the seed of digital in education, creating the infrastructure to connect villages to encouraging the establishment of advanced technologies like Artificial Intelligence including research and development through Niti Ayog’s national programme will certainly help the existing market move towards digital.

Providing Infrastructural Support to MSMEs: MSMEs have been the focus even for Rubique. It’s the most important sector yet underserved segment when it comes to access to finance. Allotment of Rs 3 lakh crore for lending in FY 19 under PM’s MUDRA Yojana for MSMEs definitely bring cheers to them. Also, government’s initiative to focus on process digitization & easing the loan sanctioning process will help & encourage the emerging fintechs like us which are taking efforts to digitize the ecosystem with increased acceptance by the ecosystem.

Focusing on Digitizing Banking: Although these initiatives will definitely help Fintech companies like us to expand & help bridge the credit gap for MSMEs, we are also hopeful to see government coming up with special tech measures to bring out e-signature facilities within banks and enable access credit digitally removing the need for paperwork which usually delays the disbursal.

Bringing innovative tech support like Blockchain: We are yet to match the security measures implemented in developed countries, hence the decision to eliminate the use of cryptocurrencies and encourage the use if blockchain in payments sector is definitely a wise decision by the government. Although several banks have started adopting blockchain technology within their existing infrastructure, it will be noteworthy to see how this tech implementation is going to shape up the financial inclusion of the country.”